The information in this brochure is for use by the recipient only. By receiving this brochure you undertake to treat its content as confidential and proprietary to Alteus Asset Management ltd. Any disclosure, copying, distribution or taking any action in reliance on the contents of this brochure is strictly prohibited and may be unlawful. Neither Alteus Asset Management ltd. nor any of its affiliates accept any liability whatsoever for the actions of third parties in this respect. The information may not be used to create any financial instruments or products or any indices. Neither Alteus Asset Management ltd. and its affiliates, nor their directors, representatives or employees accept any liability for any direct or consequential loss or damage arising out of the use of all or any part of the information.

The communication is provided for information purposes only and is solely intended as a general introduction to Alteus Asset Management ltd. (the “Company”) and its services. The materials are not intended to be complete and may change at any time.

No information related to the Company in general or to any investment vehicle or strategy in particular shall amount to an offer to enter into any contract or solicitation for the purchase or sale of any financial instrument. None of the opinions expressed shall constitute investment, tax, legal or any other advice. Any investment ideas listed do not suggest to show profitability of transactions. Investing in financial markets involves significant degree of risk and can result in the loss of substantial portion of amount invested. Nothing in the materials is intended to imply that investment in any investment vehicle is “conservative” or “risk free”. Past performance is no guarantee of future performance and should not be considered as a representation of future results. Any trade examples are provided for discussion purposes only and are not indicative of future profitability. The information on investment strategy, portfolio construction and risk parameters is current as of date listed and is subject to change without notice.

The information in the brochure is descriptive of the operations of the Company and the services, securities and financial instruments described may not be available to or suitable for the recipient. None of the services, investments or collective investment vehicles referred to in the brochure are available, and offering documents in respect of them will not be distributed, to persons resident in any state or territory where such distribution would be contrary to local law or regulation.

Any investment decision should be based on information contained in the private placement memorandum and subscription documents of the funds, managed account agreement as well as investor’s own independent decision on suitability.

Importantly, the funds are suitable only for sophisticated investors (i) that do not require immediate liquidity for their investments, (ii) for which an investment in any of the funds does not constitute a complete investment program and (iii) that fully understand and are willing and able to assume the risks of an investment in any of the funds. Investors will be required to bear the financial risks of an investment in any of the funds for an indefinite period of time. Investment in any of the funds involves the risk of loss of the entire value of an investor's corresponding investment in the fund.

The funds have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended or under the U.S. Investment Company act of 1940 as amended.

| STRATEGY CLASSIFICATION | Quantitative arbitrage |

| STRUCTURE | Cayman domiciled open-end commingled hedge fund |

| INVESTMENT OBJECTIVE | The objective of the Fund is to generate positive net return of 20%+ p.a. while maintaining a low correlation to global equity markets. The Fund seeks to achieve this objective by utilizing quantitative models designed to take advantage of a variety of arbitrage opportunities |

| INVESTMENT APPROACH | Statistical data analysis, entirely systematic process, high turnover |

| INSTRUMENTS TRADED | Cash Equities, futures contracts on equities and equity indices, futures contracts on foreign currencies, depository receipts, and option contracts on futures, equity and indices. |

| PORTFOLIO COMPOSITION | Combination of low correlated quantitative arbitrage strategies including, but not limited to:

|

| RISK APPROACH | Market neutral positions Systematic risk monitoring tools |

| INCEPTION | April 2015 |

| JURISDICTION | Cayman Islands |

| STRUCTURE | Segregated Portfolio Company |

| INVESTMENT MANAGER | Alteus Asset Management Ltd |

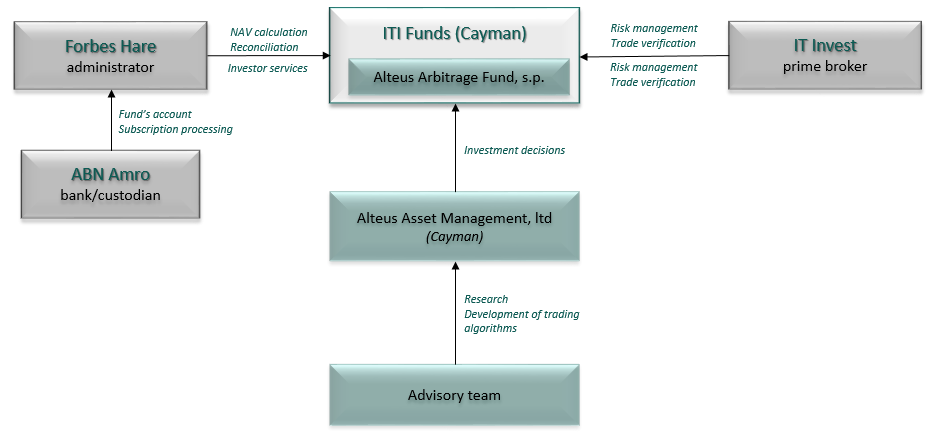

| ADMINISTRATOR | Forbes Hare |

| PRIME BROKER | IT Invest |

| MANAGEMENT FEE | 2% of assets payable monthly |

| PERFORMANCE FEE | 20% of net return payable quarterly, subject to High Water Mark |

| MINIMUM INVESTMENT | USD 100,000 |

| LIQUIDITY | Monthly |

| WITHDRAWAL NOTIFICATION | Two weeks |

| LOCK UP | no |

Eugeny Avrakhov (CEO)

Eugeny Avrakhov (CEO)

has overall responsibility for business of Alteus advisory team. Eugeny has been the CEO of Option Investment Company since 2005. Prior to launching Option Eugeny worked as an portfolio manager and Head of Algorithmic trading department at Finam, where he was responsible for development of trading algorithms focusing on derivatives markets.

Eugeniy graduated from Moscow State Techology Academy, he holds Russian Federal Financial Markets Service certification 1.0 (broker-dealer and asset management).

Alexey Khizhnyak (Chief investment advisor)

Alexey Khizhnyak (Chief investment advisor)

is responsible for determining underlying rational for algorithmic trading strategies, model assessment and development.

Before joining Option, Alexey worked for private investment management company where he was Head of algorithmic development team focusing on derivatives trading.

Alexey graduated from Ural State Technical University majoring in Finance, he holds Russian Federal Financial Markets Service certification 1.0 (broker-dealer and asset management).

Alteus quantitative development team of five highly experienced professionals with strong programming skills (С++, C#, Java, Linux) apply advanced mathematical modeling techniques to in depth examination of market micro-structure and exploring new ideas, as well as enhancement and optimization of trading and analytical tools.

Prior to starting Alteus Asset Management, Eugeny Avrakhov and Alexey Khizhnyak have built a successful asset management business with Russian licensed Option Investment & Financial Company, providing discretionary portfolio management, portfolio construction and asset allocation advisory services to private and institutional clients.

Prior to starting Alteus Asset Management, Eugeny Avrakhov and Alexey Khizhnyak have built a successful asset management business with Russian licensed Option Investment & Financial Company, providing discretionary portfolio management, portfolio construction and asset allocation advisory services to private and institutional clients.

ARBITRAGE TRADING STRATEGIES are aimed to reveal temporary mispricing in correlated pairs or baskets of exchange traded instruments and benefit from short-term price inefficiencies.

Alteus’ arbitrage strategies do not involve directional bets which allows to maintain MARKET NEUTRAL PROFILE and avoid taking excessive systemic risk.

Arbitrage strategies imply opening simultaneous multidirectional positions on a variety of instruments as opposed to making single name directional bets. This kind of bet structure prevents negative impact of market movements and allows to make profit regardless of market direction.

Arbitrage opportunities are rare and short-lived. Alteus’ trading algorithms provide CONTINUOUS MONITORING of multiple assets prices and the ability to simultaneous execution of multiple trades in related instruments within milliseconds. The investment process is ENTIRELY SYSTEMATIC and human involvement is limited to setting input parameters and emergency intervention for risk management purposes.

Not all available strategies are employed in the portfolio at the same time. While being able to identify multiple arbitrage opportunities, Alteus would only trade the most liquid ones and those with maximum potential risk adjusted return.

Increased market volatility brings more arbitrage opportunities which makes Alteus strategy a VALUABLE DIVERSIFICATION tool for portfolios of traditional assets.

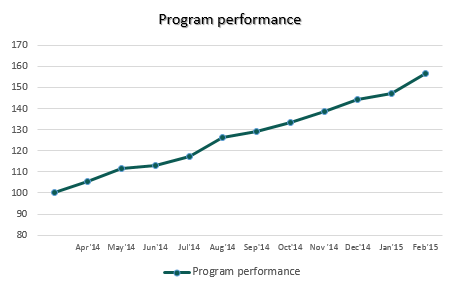

Based on Alteus advisory team track record, the Fund is expected to produce net return of over 20% p.a. with very limited downside volatility.

| Underlying: RTSI futures | Call premium 3920 | Call premium 3920 |

| Strike: 80000 | Put premium 4270 |

| MTD | YTD | |

| April** '14 | 5,6%** | 5,6% |

| May '14 | 5,5% | 11,4% |

| June '14 | 1,4% | 13,0% |

| July '14 | 3,9% | 17,3% |

| August '14 | 7,7% | 26,3% |

| September '14 | 2,1% | 29,0% |

| October '14 | 3,5% | 33,6% |

| November '14 | 3,7% | 38,5% |

| December '14 | 4,3% | 44,5% |

| January '15 | 1,8% | 1,8% |

| February '15 | 6,4% | 8,4% |